Why this Recap & Ultra Dose Matters

Preparing for the NEB Class 12 Accountancy exam can be overwhelming, especially with the updated syllabus for 2081/2082. Understanding the exam pattern is crucial: the paper typically includes 40% theory and 60% numerical questions, with a total of 75 marks for theory and practical components combined, distributed across short answers, long theory, and numerical problems. Reviewing all chapters at once helps reinforce weak areas by connecting concepts like company accounts to financial statements and cost accounting. The “Ultra Dose” approach—intensive, focused revision in the days before exams—boosts confidence, improves retention, and can help you score full marks by targeting high-weightage topics like cash flow statements and cost sheets.

Class 12 Accountancy Chapter-wise Quick Review (NEB 2082/2083)

1. Company & Formation

- Key Points: Company as legal entity, private vs. public, formation (promotion, incorporation, capital subscription), MoA, AoA, Companies Act 2063.

- Formula: None.

- Tip: Learn private vs. public differences.

2. Accounting for Shares

- Key Points: Issue at par/premium/discount, application/allotment/calls, share capital types.

- Formula: Share Premium = Issue Price – Face Value.

- Tip: Double-check forfeiture entries.

3. Accounting for Debentures

- Key Points: Secured/unsecured/convertible, issue/redemption at par/premium/discount.

- Formula: Interest = Face Value × Rate × Time/12.

- Tip: Focus on journal entries for issue/redemption.

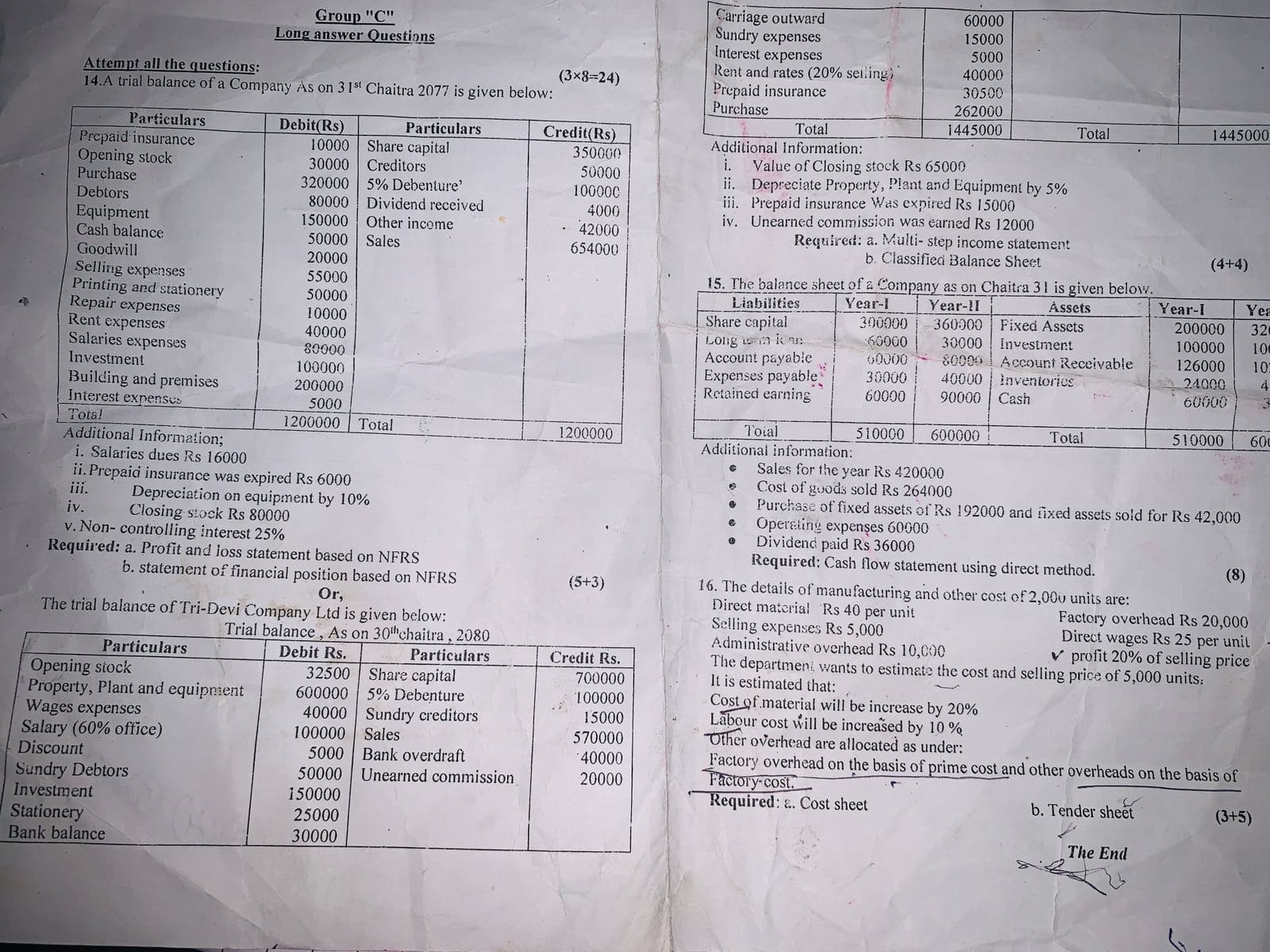

4. Corporate Financial Statements

- Key Points: P&L, Balance Sheet (Schedule VI), adjustments (depreciation, provisions).

- Formula: None.

- Tip: Stick to Schedule VI format.

5. Worksheet

- Key Points: 10-column worksheet for trial balance, adjustments, income statement, balance sheet.

- Formula: None.

- Tip: Use for complex adjustments.

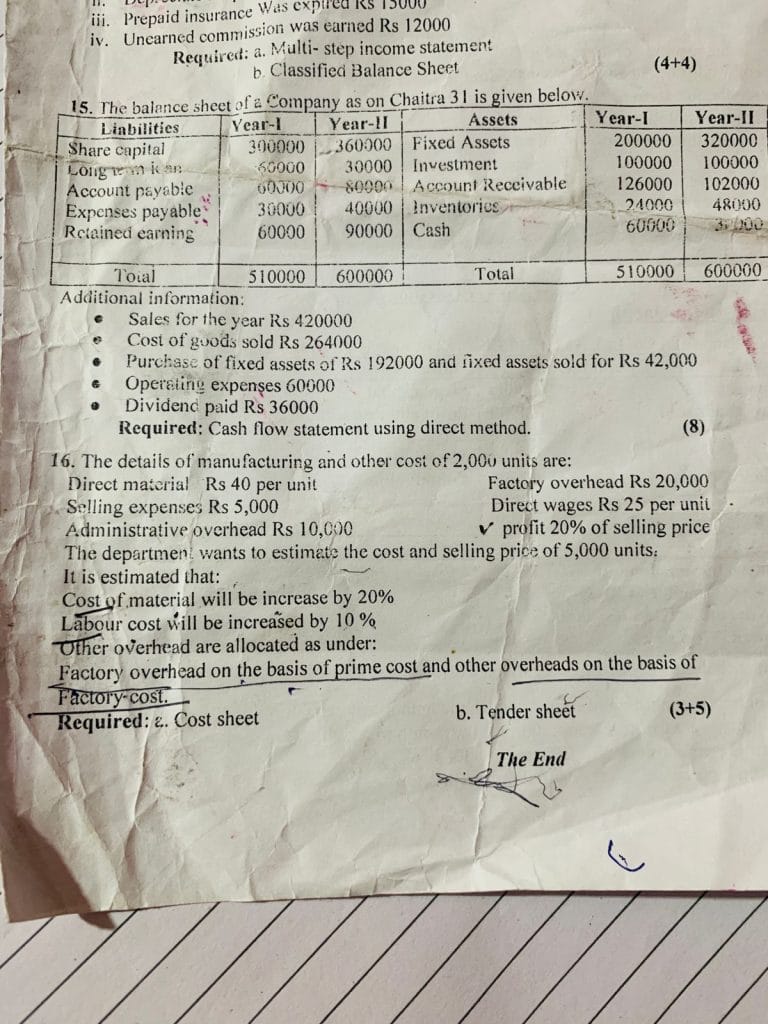

6. Cash Flow Statements

- Key Points: Direct/indirect methods, operating/investing/financing activities.

- Formula: CFO (indirect) = Net Profit + Non-Cash Expenses – Non-Cash Income + ΔCL – ΔCA.

- Tip: Master indirect method (8 marks).

7. Intro to Cost Accounting

- Key Points: Cost control, fixed/variable/semi-variable costs, cost vs. expense.

- Formula: None.

- Tip: Differentiate financial vs. cost accounting.

8. Accounting for Materials

- Key Points: Material control, EOQ, bin card, stores ledger.

- Formula: EOQ = √(2 × Demand × Ordering Cost / Holding Cost).

- Tip: Focus on inventory optimization.

9. Accounting for Labour

- Key Points: Time-keeping, payroll, Halsey/Rowan incentives, idle time.

- Formula: Time Rate = Hours × Rate; Piece Rate = Units × Rate.

- Tip: Understand idle time treatment.

10. Overheads

- Key Points: Factory/office/selling, allocation/apportionment/absorption.

- Formula: Overhead Rate = Total Overheads / Base (e.g., hours).

- Tip: Learn machine/labour hour rates.

11. Unit/Output Costing

- Key Points: Cost sheet (prime/factory/production/sales), used in mining/cement.

- Formula: None.

- Tip: Practice full cost sheets.

12. Cost Reconciliation

- Key Points: Reconciling cost & financial accounts, over/under absorption.

- Formula: Financial Profit = Cost Profit + Adjustments.

- Tip: Note notional items.

13. Computerized Accounting

- Key Points: Tally/Excel, accuracy/speed, cost/security issues.

- Formula: None.

- Tip: Practice entries in Google Sheets.

Resources:

- Download Notes: Free PDF with summaries, formulas, numericals: Class 12 Account Notes.

- Join Class: Contact +977 9745862965 via WhatsApp.

- Watch Recap: NDGURU YouTube.

Watch ultra Maha Revision full Video

Download the PDF

FAQs for Class 12 Accountancy (NEB 2082/2083)

1. What’s the exam pattern for NEB Accountancy? 75 marks: 40% theory, 60% numerical.

- Group A: 11 short questions (11 marks)

- Group B: 7 medium questions (40 marks)

- Group C: 3 long questions (24 marks, adjusted to 75).

2. Which chapters are high-weightage?

- Cash Flow Statements (8 marks)

- Cost Sheet (8 marks)

- Company Accounts (15-20 marks).

3. How to prepare in the last few days?

- Practice model questions.

- Use flashcards for formulas.

- Time practice (1.5 min/mark).

- Revise weak areas daily.

4. Any surprise questions? Rare, but expect variations of standard problems. Cover all chapters.

5. Numerical vs. theory split? 60% numerical (e.g., cost sheets), 40% theory (e.g., definitions).

6. Best revision resources?

- Ultra Revision Notes PDF.

- Nagendra Dhimal’s YouTube recap.

- NEB model questions.

- Practice in Google Sheets.

7. How to avoid exam mistakes?

- Show numerical steps.

- Include adjustments (depreciation, etc.).

- Follow Schedule VI format.

8. Is computerized accounting key? Yes, small but scoring. Learn Tally/Excel basics, advantages, limitations.

Download Notes: Free PDF with summaries, formulas, numericals: Class 12 Account Notes. Join Class: Contact +977 9745862965 on WhatsApp. Watch Recap: YouTube Live.